CFA考前知识点对比:【财报】第五讲

2016-12-27

摘要Defined contribution与Defined benefit养老金的区别 Defined benefit pension plan(养老金固定收益计划): Plan in which the company promises to pay a certain annual amount(defined benefit)to the employee after retirement.The

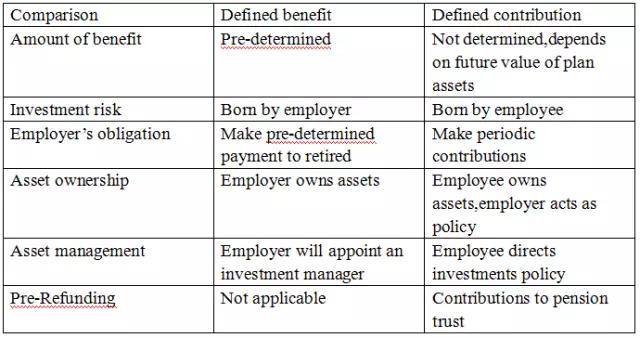

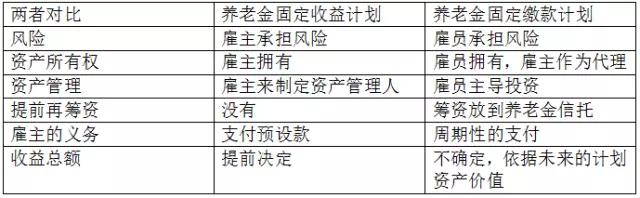

Defined contribution与Defined benefit养老金的区别

Defined benefit pension plan(养老金固定收益计划):

Plan in which the company promises to pay a certain annual amount(defined benefit)to the employee after retirement.The company bears the investment risk of the plan assets;

养老金固定收益计划:

是指雇主支持的养老金计划,员工退休、或丧失就业能力后可按工龄、职位等因素,确定一个固定的(可按通货膨胀率调整)退休津贴数额,通常按月发放直至受益人去世。是公司承诺员工退休后给予一定数量的养老金,投资风险和组合管理全部由公司承担和控制,这类养老金计划对员工无需支付罚款提取资金的时间及形式有限制,雇主在资产负债表中要记录资产和负债。

Defined contribution pension plan(养老金固定缴款计划):

Individual accounts to which an employee and typically the employer makes contributions,generally on a tax-advantaged basis.The amounts of contributions are defined at the outset,but the future value of the benefit is unknown.The employee bears the investment risk of the plan assets.

养老金固定缴款计划:

公司每隔一段时间向退休账户中存入一笔钱,雇员承担风险,但未来的价值和收益是不确定的。对于公司来说,会计处理相对简单,养老金费用就是每期付出去的钱,资产负债表中也没有养老金的未来义务,在利润表中记录费用。

两者的对比:

例:In a defined benefit pension plan:

A.the employee is responsible for making investment decisions.

B.the employee is promised a periodic payment upon retirement.

C.the employer’s pension expense is equal to its contributions to the plan.

答案:B

【解析:】

In a defined benefit pension plan,a periodic payment,typically based on the employee’s salary,is promised to the employee upon retirement and the employer contributes to an investment trust that generates the principal growth and income to meet the pension obligation.The employees do not direct the investments in their accounts as they do in a defined contribution plan.Pension expense for a defined benefit plan has several components,including service cost,prior service cost,and interest cost,and depends on actuarial assumptions and the expected rate of return on plan assets.

对于养老金固定收益计划,雇员是同意在退休后接受周期性固定的养老金,所以B是对的;但雇员不做投资决定,是雇主做投资并承担相应风险的,所以A错误;雇主的养老金费用等于计划缴款的金额是针对养老金固定缴款计划的,所以C错误。

现在,只要花十秒钟免费申请获取精心研发的2017年CFA资料,免费索取CFA学习资料电子版,提升CFA备考效率和成绩. >>点我免费领取2017年cfa资料

现在,只要花十秒钟免费申请获取精心研发的2017年CFA资料,免费索取CFA学习资料电子版,提升CFA备考效率和成绩. >>点我免费领取2017年cfa资料

CFA考试百科

CFA考试百科

24年全新CFA报名流程&预约考位流程!

24年全新CFA报名流程&预约考位流程!