CFA考前知识点对比:【数量】第五讲

2016-12-28

摘要Time-weighted rate of return和Money-weighted rate of return的对比及计算 Time-weighted rate of return(时间加权的回报率):Time-weighted rate of return measures the compound rate of growth of$1 initially invested in the por

Time-weighted rate of return和Money-weighted rate of return的对比及计算

Time-weighted rate of return(时间加权的回报率):Time-weighted rate of return measures the compound rate of growth of$1 initially invested in the portfolio over a stated measurement period.

时间加权的回报率是指在一个确定的衡量期间内,在期初投入1美元,在期末可以收回金额的复合回报率。或者说,时间加权收益率是指在每单位时间区间计算其金额加权收益率后,计算整个时间区间收益率的几何平均数。时间加权类似于几何平均收益率,考虑了资金的时间价值,运用了复利思路。

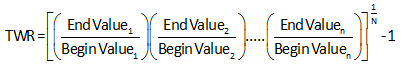

Calculation of TWR:Break the overall evaluation period into sub-periods based on the dates of significant cash inflows and outflows;Calculate the HPRs for each sub-period;Link or compound HPRs to obtain an annual rate of return.

计算方法:把一个整体期间按产生现金流的的时间点划分为几个子区间,计算每个子区间的持有期收益率,这些子区间相乘得到整体时期的收益率。

注:N和n不一定相等

Money-weighted rate of return(价值加权的回报率MWR):MWR accounts for the timing and amount of all cash flows into and out of the portfolio.

价值加权的回报率,是在考虑所有的现金流入及流出的情况下,一个投资组合的内部回报率。

If more funds to invest at an unfavorable time,MWR will tend to be depressed;If more funds to invest at a favorable time,MWR will tend to be elevated.

所有的现金流入和流出都会影响价值加权的回报,且现金流大的所占权重更大;

Calculation of MWR:similar to IRR.

计算方法:TWR vs.MWR

Time weighted rate of return:Not affected by cash withdrawals or additions;Periods can be any length between significant cash flows.

Money weighted rate of return:Assign more weights to the return of larger cash flows;Affected by cash withdrawals or additions;Periods must be equal length.Use shortest period with no significant cash flows.

两者区别:价值加权划分的每一期间都是相等的,时间加权的每一期间可以不等;期间现金流入或流入对于时间加权没有影响,而会影响价值加权法;大的现金流在价值加权回报中占据较大的权重;因为价值权重要求每期的长度相等,所以划分时间区间时要以没有重大现金流的的较小区间为准;

考点:一般会考两者的计算,或者比较两者的大小;

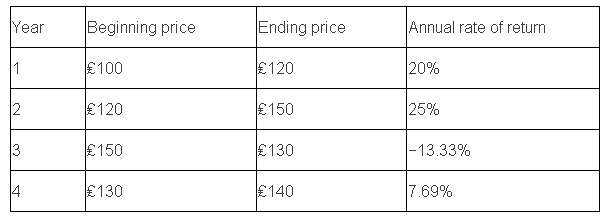

例:Miranda Cromwell,CFA,buys₤3,000 worth of Golden shares at the beginning of each year for four years at prices of₤100,₤120,₤150 and₤130 respectively.At the end of the fourth year the price of Golden is₤140.The shares do not pay a dividend.Cromwell calculates her average cost per share as[(₤100+₤120+₤150+₤130)/4]=₤125.Cromwell then uses the geometric mean of annual holding period returns to conclude that her time-weighted annual rate of return is 8.8%.Has Cromwell correctly determined her average cost per share and time-weighted rate of return?

Average cost Time-weighted return

A.Correct Correct

B.Correct Incorrect

C.Incorrect Correct

答案:选C

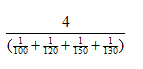

解析:Because Cromwell purchases shares each year for the same amount of money,she should calculate the average cost per share using the harmonic mean.Cromwell is correct to use the geometric mean to calculate the time-weighted rate of return.The calculation is as follows:

TWR=[(1.20)(1.25)(0.8667)(1.0769)]1/4−1=8.78%.Or,more simply,(140/100)1/4−1=8.78%。

关于平均成本,因为每年用等量的货币来购买,应该用调和平均数来算平均成本,即为:

相关CFA知识推荐:

连考研都失败了,咸鱼的梦想几时翻身?

CFA考前知识点对比:【经济】先进讲

CFA考试百科

CFA考试百科

24年全新CFA报名流程&预约考位流程!

24年全新CFA报名流程&预约考位流程!