CFA考试精华集锦:CFA一级通关秘籍之你问我答

2019-05-13

摘要CFA考试精华集锦:CFA一级通关秘籍之你问我答;最近有考生私信中国CFA考试网老师,做了一套cfa一级题,正确率不高。下面整理了一套CFA一级优秀考生整理的常见考题以及详细解答。已

CFA一级通关秘籍之你问我答,涉及10个科目内容。最近有考生私信中国CFA考试网老师,做了一套cfa一级题,正确率不高。下面整理了一套CFA一级优秀考生整理的常见考题以及详细解答。已上传论坛,满满的干货!许多备考CFA都会遇到的问题在这里都有解答!【点我下载】

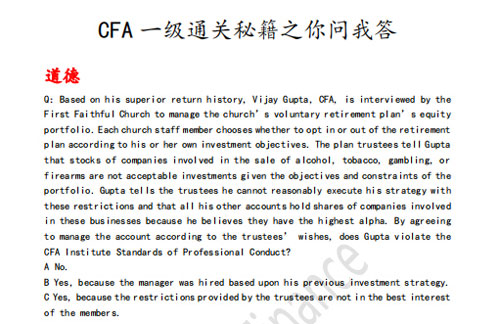

1.道德

Q:Based on his superior return history, Vijay Gupta, CFA, is interviewed by the

First Faithful Church to manage the church’s voluntary retirement plan’s equity

portfolio. Each church staff member chooses whether to opt in or out of the retirement

plan according to his or her own investment objectives. The plan trustees tell Gupta

that stocks of companies involved in the sale of alcohol, tobacco, gambling, or

firearms are not acceptable investments given the objectives and constraints of the

portfolio. Gupta tells the trustees he cannot reasonably execute his strategy with

these restrictions and that all his other accounts hold shares of companies involved

in these businesses because he believes they have the highest alpha. By agreeing

to manage the account according to the trustees’ wishes, does Gupta violate the

CFA Institute Standards of Professional Conduct?

A No.

B Yes, because the manager was hired based upon his previous investment strategy.

C Yes, because the restrictions provided by the trustees are not in the best interest

of the members.

A:根据 Gupta 优越的回报历史,FF 教会让 Gupta 负责管理教会的养老金的。每个教会工作

人员根据自己的投资目标,选择是否参加养老金。该计划的受托人告诉 Gupta,考虑到投资

组合的目标和限制,参与销售酒精、烟草、赌博或火器的公司股票是不可接受的。G 告诉受

托人,他不能合理地执行这些限制的策略,他的所有其他账户都持有参与这些业务的公司的

股份,因为他认为这些公司拥有最高的 alpha。如果 Gupta 同意按照受托人的意愿管理帐户,

Gupta 是否违反了 CFA 协会的准则。

Gupta 对养老金计划的参与人和受益人承担忠诚谨慎的义务。作为一项教会的养老金计划,

不参与烟酒赌博军火公司股票的限制是适当的,属于教会的 unique circumstance。并且

Gupta 作为基金经理已经事先提醒了相关的风险。如果 Gupta 同意按照受托人的意愿管理帐

户,是按照教会受托人的授权进行的投资,是正确的,所以选 A。

CFA 一级—道德—R3—Standard III(C). Suitability

Q:Henrietta Huerta, CFA, writes a weekly investment newsletter to market her

services and obtain new asset management clients. A third party distributes the free

newsletter on her behalf to those individuals on its mailing list. As a result, it

is widely read by thousands of individual investors. The newsletter recommendations

reflect most of Huerta’s investment actions. After completing further research on

East—West Coffee Roasters, Huerta decides to change her initial buy recommendation

to a sell. To avoid violating the CFA Institute Standards of Professional Conduct

it would be most appropriate for Huerta to distribute the new investment

recommendation to:

A newsletter recipients first.

B asset management clients first.

C newsletter recipients and asset management clients simultaneously.

A:Henrietta Huerta 为了招揽客户,定期给一些人发送报告,为了吸引更多的客户来做资

产管理,newsletter receipts 的人群是 Huerta 想要招揽的客户。在提出投资建议或改变

投资建议时,必须优先考虑通知现有的客户,而不是为自己招揽客户,所以选 B。

CFA 一级—道德—R3—Standard III(A). Loyalty, Prudence, and Care

Q:Rodney Rodrigues, CFA, is responsible for identifying professionals to manage

specific asset classes for his firm. In selecting external advisers or subadvisers,

Rodrigues reviews the adviser's investment process, established code of ethics, the

quality of the published return information, and the compliance and integrated

control framework of the organization. In completing his review, Rodrigues most

likely violated the CFA Institute Standards of Professional Conduct with regard to

his due diligence on:

A. adherence to strategy.

B. internal control procedures.

C. performance measures.

A:这道题想要考察的知识点是我们选择外部的投顾的时候,应该要从哪些方面进行审查。

题目给出了 Rodney 从哪些方面 review,题干问 in completing his review,为了使 review

完整,还应该从哪些方面审查,所以选 A,这个外部的投顾是否遵守了投资策略。

CFA 一级—道德—R3—Standard V(A). Diligence and Reasonable Basis

Q:Carter works for Invest Today, a local asset management firm. A broker that

provides Carter with proprietary research through client brokerage arrangements is

offering a new trading service. The broker is offering low—fee, execution—only

trades to complement its traditional full—service, execution—and—research

trades. To entice Carter and other asset managers to send additional business its

way, the broker will apply the commissions paid on the new service toward satisfying

the brokerage commitment of the prior full—service arrangements. Carter has always

been satisfied with the execution provided on the full service trades, and the new

low—fee trades are comparable to the fees of other brokers currently used for the

accounts that prohibit soft dollar arrangements.

A. Carter can trade for his accounts that prohibit soft dollar arrangements under

the new low—fee trading scheme.

B. Carter cannot use the new trading scheme because the commissions are prohibited

by the soft dollar restrictions of the accounts.

C. Carter should trade only through the new low—fee scheme and should increase his

trading volume to meet his required commission commitment.

A:Carter 在一家投资公司工作。一家经纪商正在提供一种新的交易服务。该新型服务是低

费率、只提供执行交易指令以替代以往的全方位、包括执行指令以及研究服务。为了吸引 C

以及别的资产管理公司,该公司正在尝试着将两种服务模式结合,主要是佣金水平的下降以

及提供服务的尽量全面性。C 一直以来都很满意过去的全服务模式下提供的执行交易指令的

服务,而新的低费率与其他经纪商没有软美元安排的佣金费率水平相差无几。

该问题主要与 III(A)相关。由于 C 相信该经纪商是在与其余经纪商差不多的佣金水平下提

供了更高性价比的服务,他可以继续就所有类型账户与该经纪商保持合作关系,自然也就包

括没有软美元安排的账户。所以本题选 A。

CFA 一级—道德—Reading3—Standard III(A). Loyalty, Prudence, and Care。

中国CFA考试网(www.cfa.cn)综合整理,来源:中国CFA考试网,原创文章,经授权转载,若需引用或转载,请注明出处 ,仅供参考、交流之目的。

CFA考试百科

CFA考试百科

24年全新CFA报名流程&预约考位流程!

24年全新CFA报名流程&预约考位流程!