CFA考前知识点对比:【财报】第九讲

2016-12-26

摘要Conservative accounting和aggressive accounting的具体比较 l Conservative Accounting(稳健的会计原则): Conservative accounting uses methods that are more likely to understate,rather than overstate,financial performance.In mo

Conservative accounting和aggressive accounting的具体比较

l Conservative Accounting(稳健的会计原则):

Conservative accounting uses methods that are more likely to understate,rather than overstate,financial performance.In most cases,managers and investors want their businesses to be conservative in their accounting practices.This is because conservative accounting is more likely to undervalue investments rather than overvalue them,leading to management that is more likely to carefully manage risks and exceed expectations.A business that plans conservatively for growth essentially builds in considerable room for error.

稳健的会计原则:

使用的会计方法倾向于低估而不是高估财务表现。大部分情况下,管理层和投资者都希望是稳健的会计准则应用在公司财报中,因为稳健的会计准则倾向于低估运营表现,导致管理层更为仔细地管理风险,因此一般会比预期的表现的好,一个谨慎的商业计划在考虑增长时会将风险因素考虑在内。

l Aggressive Accounting(激进的会计原则):

Aggressive accounting,by contrast,might employ more creative techniques that result in overstated financial performance.Unfortunately,many companies are often pressured to do this so they can present the company's performance in the best light for investors and analysts.Nonetheless,aggressive accounting exposes investors and managers to more risk because they are less likely to manage carefully for risks if they're more comfortable with their performance.In addition,aggressive accounting is more likely to result in restatements of performance,which can diminish the credibility of a company's management

激进的会计原则:

使用一些创造性的方法导致高估财务报表的表现。不幸的是,很多公司会迫于压力去选择激进的方法由此给投资者和分析师呈现出较好的一面,但是,这样管理层也不会特别仔细的控制风险因此给投资者带来了更大的风险,激进的会计原则有可能导致财务表现的重新评估或调整,因此会减少管理层的公信力。

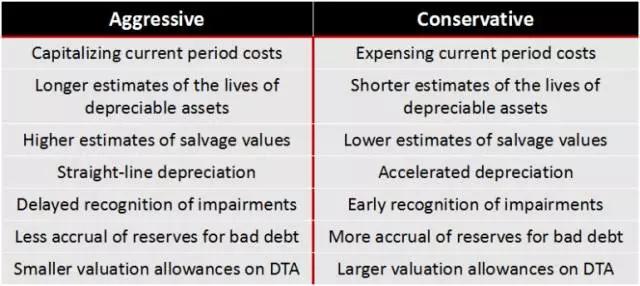

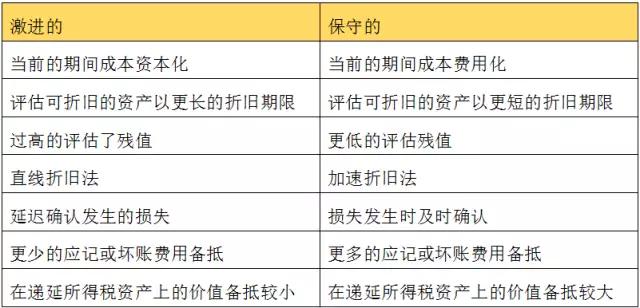

两者在会计处理上的对比:

例:In general,firms making aggressive accounting decisions will report book values that are:

A.higher.

B.consistent with fair market value.

C.Lower.

【Answer:A】

解析:In general,firms making aggressive(conservative)accounting decisions will report higher(lower)book values and lower(higher)future earnings.

激进的会计方法会使公司的账面价值过高,从而高估公司的表现。看完CFA财报相关内容,再来了解下CFA相关备考资料吧→>>点击领取CFA免费资料大礼包

来源|金融先进考 若需引用或转载,请联系原作者,感谢作者的付出和努力!

相关CFA知识推荐:

CFA一级考试科目学习顺序

CFA工作经验如何认证?

来源|金融先进考 若需引用或转载,请联系原作者,感谢作者的付出和努力!

相关CFA知识推荐:

CFA一级考试科目学习顺序

CFA工作经验如何认证?

CFA考试百科

CFA考试百科

24年全新CFA报名流程&预约考位流程!

24年全新CFA报名流程&预约考位流程!